CENTRALIZED PURCHASING

My Role

Product Designer

Strategic vision/thinking

UX research

Team

2 Designers

4 Product Managers

Timeline

Phase 1: User research

Phase 2: Multi-location purchasing

Background

Centralized purchasing is a procurement model where a particular individual or department is responsible for procuring goods for all of the company’s dispensary locations.

Problem

At a high-level LeafLink lacked features that enable buyers to easily purchase for all their locations at once.

Our mission was to conduct research on current purchasing patterns, audit the experience to find any gaps or opportunities for improvement, and build upon our existing multi-location ordering page.

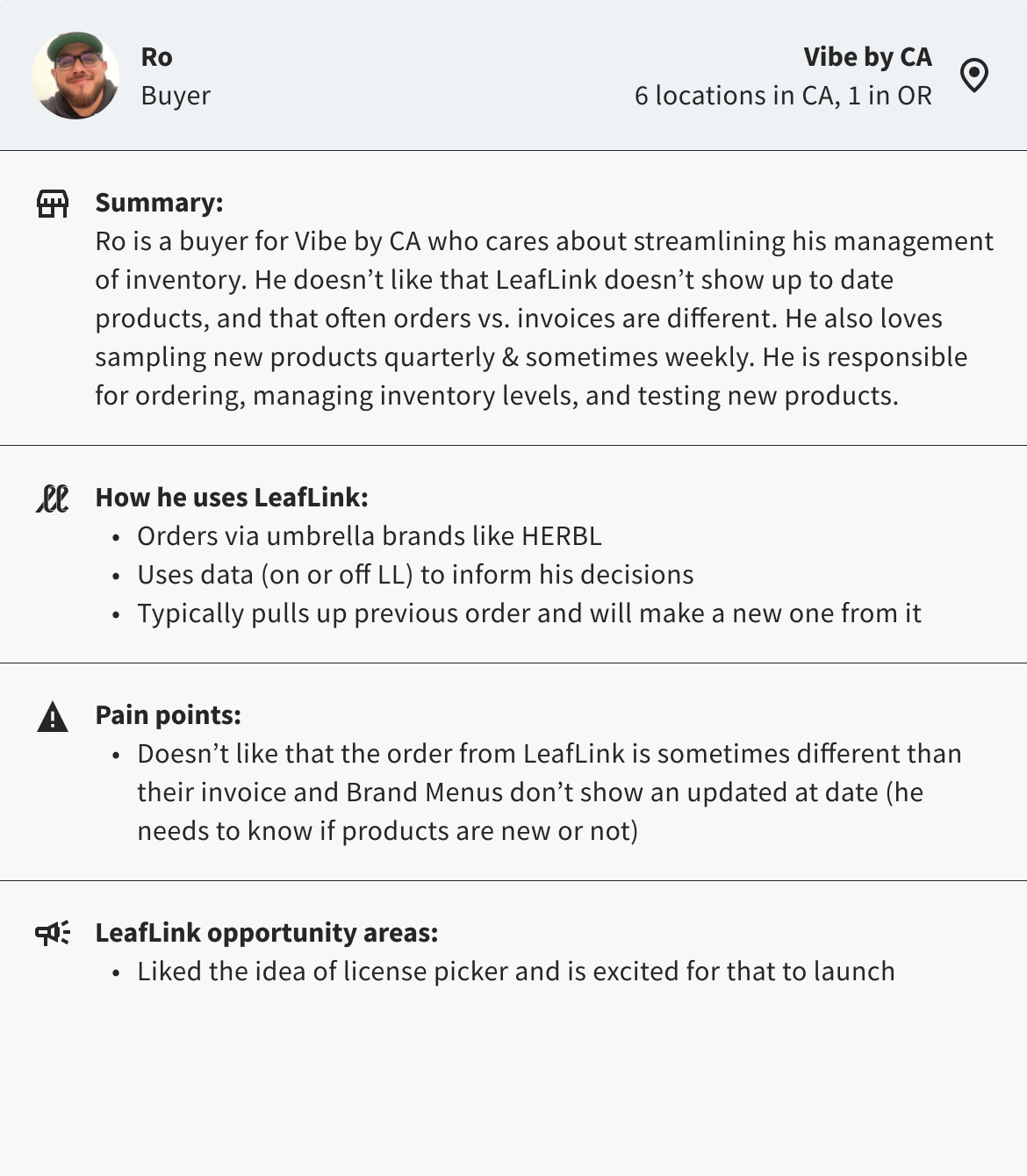

Participants

We had 4 zoom meetings in total and wanted to focus on 3 main themes (Streamlined reordering, Reporting, and Discovery)

PHASE 1 (Q4 2021): RESEARCH & DISCOVERY

Summary

Streamlined reordering

Bigger buyers mostly order by brand level, smaller buyers (1 location) order at more product level (need more data)

All love sampling / testing new products (by brands they already know) / Do orders on and off LeafLink which creates more work

Ordering schedules are generally kept and we have the opportunity to automate some of this

Need to know what’s in stores, on order, in transit, and sell-through rate (inventory page)

Generally, place similar orders each week and want the ability to create templates (purchase list)

Send the same types of communications often (ex. out of stock requests)

Next steps: Continue to streamline general ordering as much as we possibly can, while also working on features that will speed up ordering for multi-store locations (Purchase List, setting up hub locations, etc.)

Reporting

Heavily uses data to inform purchasing decisions

LeafLink needs more robust reports/dashboards to account for multiple stores, centralized purchasing ops, and general forecasting & planning

Users love reports and use them very frequently to inform their purchasing decisions.

Next steps: Look into what other types of reports we can add. Most requests were territory based. Others were aging reports, daily sales by breakdown, sales by customer (rec/med then SKU), seasonal trends, hot products, and specials.

Discovery

Product-level feedback is important (from customers, employees, etc - they won’t sell it if budtenders don’t like it)

Next steps: Different stores have different demographics so recommendations should be tailored to this. Ability to add non-LeafLink sellers’ contact info which would then trigger an email to that brand rep asking if they’d be interested in LeafLink. Adding rating systems for product level (photos don’t do justice, they want to know the quality of the product, especially flower)

Problem

Every time you switch your license/location the platform does a hard refresh and lands you on your dashboard instead of saving where you were in your flow. This is a barrier to a user continuing the same workflow for a different license.

Old flow

From the Shop Products page, you would select your product.

Click the ‘View product detail page’ link above ‘Request Sample’.

Click the ‘Add to cart for another store’ link under ‘Add to Cart’

Another modal will pop up to send to other stores.

This was a very tedious process and we needed to find a solution.

PHASE 2 (Q1 2022): QUICK WINS

Tech limitations & solutions

LeafLink is currently a multi-page app meaning it reloads the entire web page content instead of only data necessary for the user. Because of this, we had to create a temporary solution for this problem.

After some digging on engineering’s part, we discovered that if we moved the license switcher out of the side nav and added one to the page content it would do a soft refresh, keeping your position in the platform. This solution, albeit, temporary unlocked the potential to add the switchers to some key buyer pages: Shop Brands/Brand Menu, Shop Products/PDP Modal, and Orders which are the 3 most frequented pages by buyers. This then allowed buyers to move through their multi-location purchasing flow faster without having to lose their place.

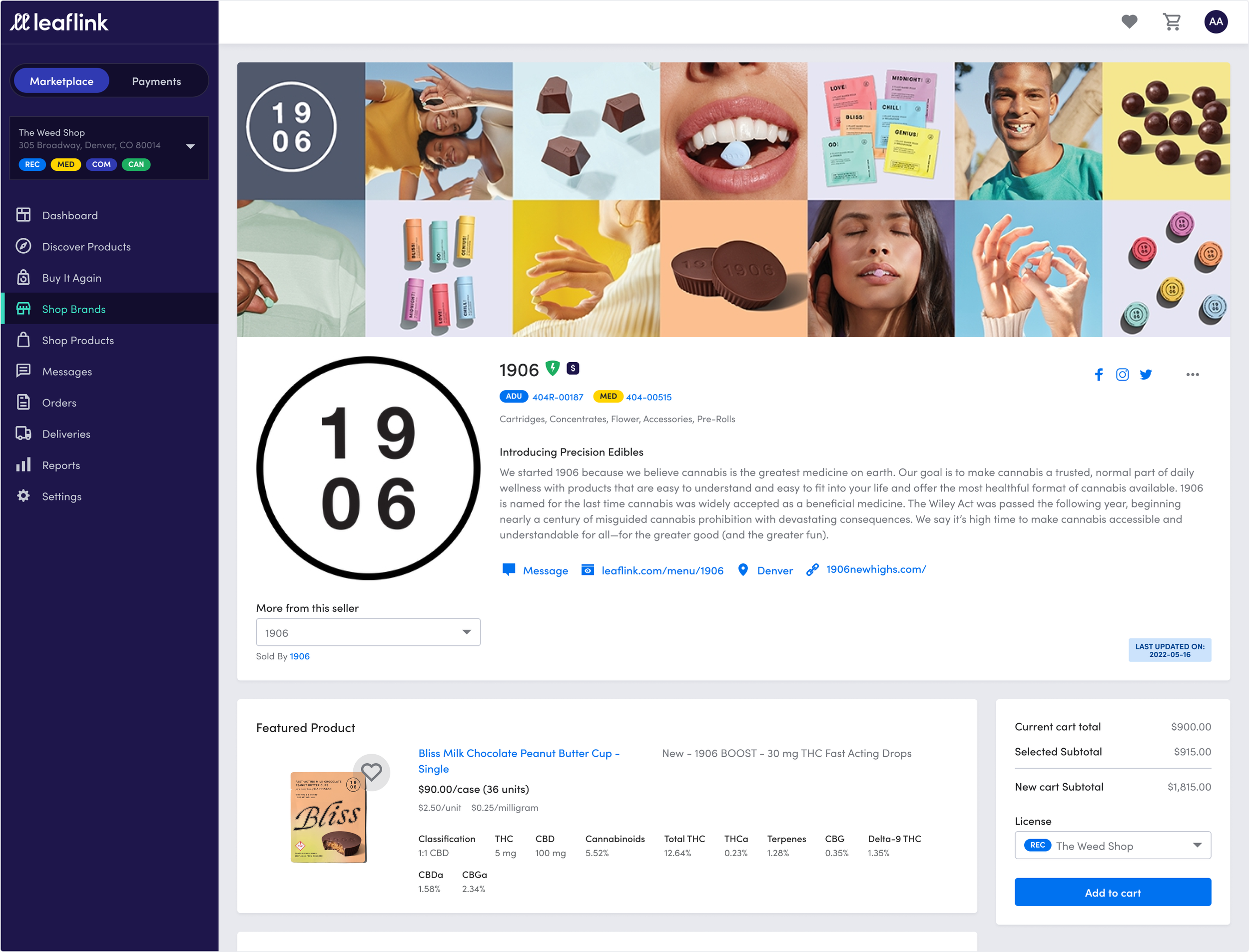

Brand Menu

Brand Menus take up 4% of sitewide traffic, and 21% of buyer site traffic, and are the most trafficked type of buyer page.

To this, we added a license switcher in the sticky cart so that buyers can add all their products from 1 brand to a store at once, then seamlessly switch the license and add other quantities to the other.

Product Detail Modal

~11% of product “add to cart” events come through the Product Detail (PDP) modal.

To this, we added the ‘Add another location’ link that then reveals another quantity field and license selector. Users are then able to add the product to any eligible license.

Orders

The orders page takes up 7% of buyer site traffic and is the 5th most trafficked buyer page. 42,230 license changes have originated from the Orders page as of Jan 2022.

To this, we added a license switcher in the top right corner so that buyers can seamlessly switch between their stores. We also added an ‘All licenses’ checkbox that would then show all orders across all locations.

PROTOTYPE

Follow the instructions on the side bar to move through the flows.