CALIFORNIA RESEARCH TRIP

My Role

Product Designer

UX research

Team

1 Designer

1 Product Manager

Timeline

June 2021

Background

Where we stood with CA (June 2021):

34% of retailers with a LeafLink account that had never logged on were CA buyers

45% of retailers who had not logged on in the past 3 months were CA buyers

26% of our SGO (seller-generated orders aka orders placed by the seller) Heavyweight retailers (>75% of orders are SGOs) were CA buyers

CA buyers had the least amount of weekly sessions and weekly page views and this is correlated with purchasing frequency

40% of the ‘Low GMV’ and ‘Medium-Low GMV’ buyers were CA buyers

Goals

Uncover and recommend product opportunities to increase buyer engagement in CA

Validate and learn more about the centralized purchasing concept

Understand how relationships are created and fostered

Understand why buyers don't place BGOs (Buyer Generated Orders aka orders placed by the buyer) once a relationship is established

Understand how buyers are using the platform if they aren't placing BGOs

Learn about sampling processes

Learn how terms are negotiated and agreed upon

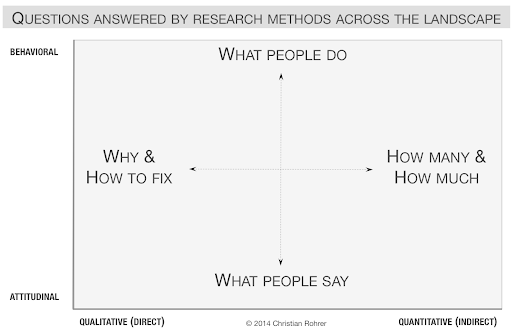

Our Approach: Attitudinal vs. Behavioral

This distinction can be summed up by contrasting "what people say" versus "what people do" (very often the two are quite different).

Non-directed interviews

Contextual interviews

First Click Testing

Usability Testing

We wanted to see people in their work environment interacting with LeafLink or non-LeafLink interactions

Participants

All personas:

were glued to their phones 24/7, need to know what is currently in store/in transit/on order, and they all expressed that LeafLink requires double entry of orders

Victor’s Pain Points

Prefers to pick up the phone and talk to a real person, and doesn’t want back and forth

Centralized purchaser (meaning he purchases inventory for all of his locations at once, ships them to his main store, and distributes them to their other locations from that main hub)

Ty’s Pain Points

Is always on Instagram looking for new things to purchase

Vendor-controlled inventory management (meaning the seller controls what items are sold in his stores)

Introduced the Slotting Fees concept to the cannabis industry

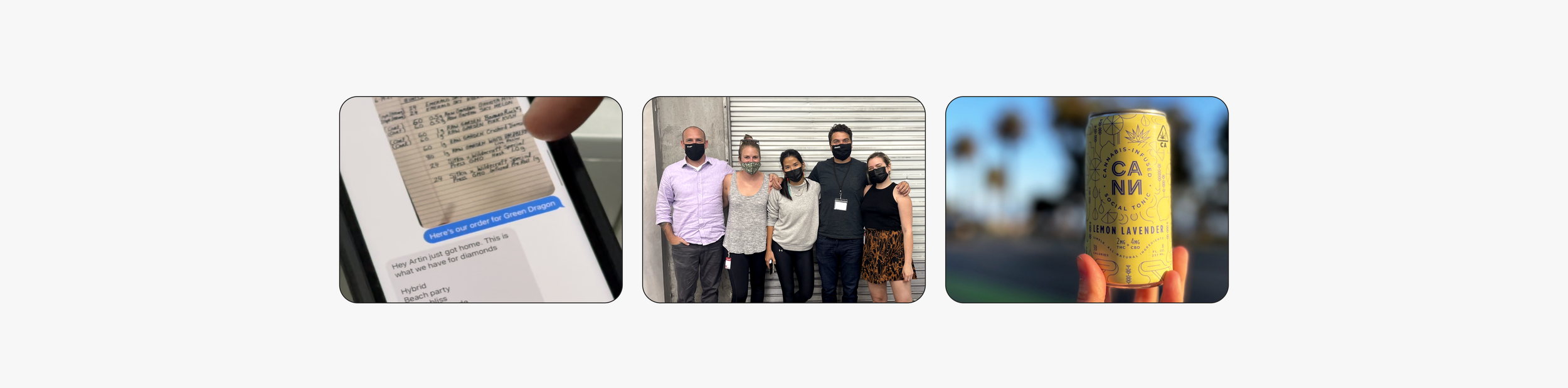

Artin’s Pain Points

Requests his menus via text and records the store’s orders via paper & pen

Expressed that the platform was not intuitive for him to use as a first-time user

Themes we saw

Centralized Purchasing

Retailers who have multiple locations, purchase in bulk to a main hub and distribute that inventory to all their locations.

What we observed:

Buyers are bulk purchasing for all their locations together

Goods are sent to one location and stored in the back room

Different systems are used to “distribute” the products to individual locations but no company has a great tech solution to facilitate this

Seller-controlled Inventory Management

Sellers who manage the inventory/product selection for retailers by placing orders on their behalf (via LeafLink or through their own systems)

What we observed:

Brands aid in or entirely manage which products and how much inventory to order for the retailers

Retailers will send the inventory currently on the shelf

Brands look for holes in inventory and place the order on the retailer’s behalf

Data Informed Purchasing Decisions

Retailers use various different platforms to assess their inventory and often manually analyze their data to help inform purchasing decisions

What we observed:

All buyers looked at the inventory they already have in store (POS)

Check to see what inventory they have in transit (Metrc)

Look to see what inventory they have on order (LeafLink and/or ERP)

Calculate a sell-through rate, make any manual adjustments and then place orders

LeafLink orders then need to be entered again into the ERP

Mobile Usage & Platform Usability

Buyers and Sales Reps are constantly communicating via texting or calling to place orders or manage inventory instead of using the platform. Buyers in CA also often find the LeafLink platform confusing to use and express that it’s just easier to call or text in their orders to a Sales Rep.

Mobile Usage

What we observed:

Purchasing Managers are always on their phone, texting in orders, and calling for order updates

Requesting their brand’s latest menu by text message

Responding to the text with what they want to order off the menu

Platform Usability

What we observed:

Not easily searchable (Distro search non-existent / All searches are very rigid)

UX is confusing to navigate especially for a first-time user

Brand Menus are difficult to gain relevant information (such as terpene content for cartridges) because there is so much content spaced out, whereas in their excel sheets they can see everything all at once

Summary & Solutions

During this trip, we learned that the CA market served as an example of how cannabis purchasing habits are antiquated & complicated.

Once we returned to NY, we reviewed & synthesized all of our research and came up with some key problems and how we planned to solve them in the coming quarters.